FUD. Fear, Uncertainty, Doubt.

Following the FTX collapse, many famous crypto twitter accounts, journalists and influencers who were impacted by Sam Bankman’s fraud started pointing fingers at Binance as the next exchange to fall; they picked the ideal scapegoat: Changpeng Zhao, known as CZ, CEO and co-founder of the number one exchange Binance. Many tweets have been shared regarding potential withdrawal issues, simultaneously many twitter accounts published investigative threads presenting why Binance’s financial health is strong, which has translated in the last few days as Binance being able to match all withdrawal requests.

In spite of CZ's efforts to convey peace and calm, the crypto space is still rocked by waves of panic and uncertainty surrounding Binance. Sadly, it wasn't just Binance that was going through tough times, in fact, Gemini was down for a few hours last Friday. Due to technical works, or so they say. Another example is OKX, the Seychelles-registered cryptocurrency exchange, which suspended operations for more than 9 hours this Sunday. Another reason behind the increasing worries.

But Binance is a bigger fish and the hyper reactivity of Crypto Twitter brings a load of warnings and accusations that Binance is heading for a cliff.

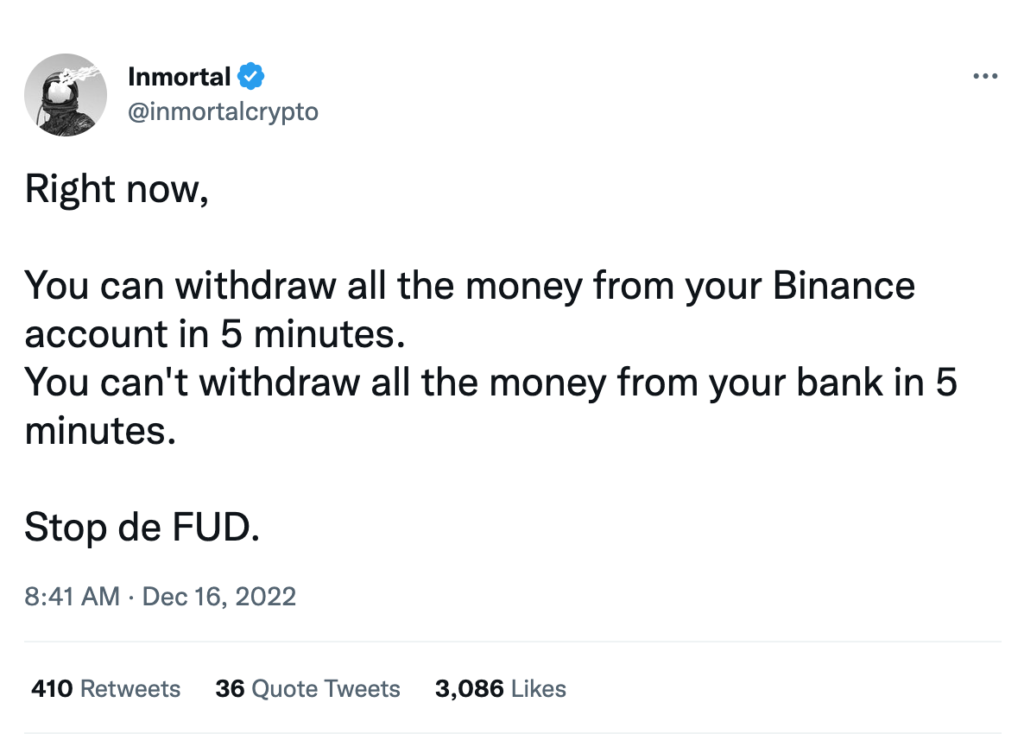

Fortunately, at the same time, some users just shrugged and spat out three words: Fear. Uncertainty and Doubt. Both novice and professional Binance users are confident. In their view, all panic has no cause and is just an overreaction, as proven by the article regarding the money laundering business with Iranian firms, these accusations first appeared in 2018 and seem to be nothing more than recycled newspaper fear mongering.

At the start of December 17 weekend, a wave of withdrawals began to rock Binance. You see, the audit firm that used to work for Binance, Mazars... suddenly quit. They announced that they would sever all ties with crypto companies. They even took down their website so they could get away with it.

People took Mazar’s stepback as a sign while two large ethereum holders sold 23,000 ethereum after a long period of inactivity…… coincidence? The fear caused Binance's native BNB token to fall to its lowest price since July, just above 221 dollars.

Given the recent sentiment surrounding CZ and his exchange, people chose the exit button. In the last week alone, Binance processed successfully withdrawals worth over $14 billion! It's enormous. All of this is happening despite the well-known (and easily verifiable online) fact that Binance has over $54 billion in reserves.

The reason behind this panic stems from the downward spiral of FTX, everyone became more paranoid. And everyone became more critical, more careful and more reactive.

Now let’s explore four critical facts about Binances health:

ONE:

Mazars stopped ALL crypto audits, not just Binance.

Mazars audited http://Crypto.com, Kucoin, and Binance. They removed their audits of ALL of these exchanges.

That's a Mazars problem. Attempts to make it look like a Binance problem reeks of desperation.

Mazars could have stopped the *crypto-audits* because they felt it was too risky for them, which is understandable in this climate.

Since the implosion of FTX, traditional financial companies have become increasingly wary of cryptocurrencies.

For example, banks have started banning crypto user accounts.

Auditing firms refusing to work with crypto companies does not mean they are insolvent, just like it does not mean a bank refuses to work with crypto users.

Based on Mazars' claim that Binance's insolvency is a desperate attempt to create fear, especially if the exit process is successful

TWO:

Binance currently has over $55 billion in reserves, according to ChainData. That's a fact. Easily verifiable on the blockchain. The claim of a “bank run” on Binance when only a fraction has been withdrawn is absurd to say the least. According to on-chain data from CryptoQuant, Binance processed withdrawals worth over $14 billion last week alone!

About half of those withdrawals happened in one single day, December 13, the exchange still has over $55 billion in reserves! These are not symptoms of an insolvent exchange or bank run. Quite the contrary!!! FTX had virtually no reserves and was eager to get funds from different sources to send to their wallets for user withdrawals.

Binance is obviously not FTX, comparing both exchanges is a feeble attempt to induce panic. As Crypto Quant explains in this tweet, on-chain data shows the difference between FTX and Binance

Three:

Finally, there’s unfounded rumors that Binance has a reserves problem because it holds loads of BUSD. Good news: the stable-coin BUSD is NOT issued by Binance. BUSD is in fact issued by Paxos, backed by US dollars & T-bills, and approved AND regulated by the New York State Department of Financial Services (DFS).

The fact that BUSD is regulated by the DFS can easily be found on the website of the New York State Government:

https://dfs.ny.gov/reports_and_publications/press_releases/pr1909051

In other words, BUSD is regulated in the US and is simply a lot safer than USDT (which has been attacked for years now and is still yet to collapse).

As you can see from the facts in this thread, attempts to trigger panic around Binance are misinformed, show a clear lack of understanding, or are intentionally aimed at stirring panic and hate towards Binance based on unfounded claims. They are attacks against crypto, plain and simple!

-

No one wants another drama like FTX, so now Binance has to contend with the constant wave of scrutiny. Luckily, and all credits to them, they seem to be doing well. Just yesterday, Binance has acquired Tokocrypto, an Indonesian cryptocurrency exchange. Also, it has just been announced that Binance.US has agreed to acquire the assets of failed cryptocurrency lender Voyager Digital for 1 billion dollars.Although Binance.US operates independently from Binance, it can safely be considered a decision on Binance's part.

Most aspects attest of a strong healthy position by Binance, what is more reassuring is the strength displayed in spite of the current distrust towards digital assets and the ecosystem as a whole. Binance and CZ will only grow stronger by pushing transparency further in the coming year.

Despite all the "healthy" symptoms highlighted here and no matter how strong Binance appears to be, we can never repeat this enough: keep your cryptos off exchanges. Not your keys, not your coins!