The cryptocurrency market has been experiencing a bumpy ride, mainly downward, since mid November. Most crypto currencies have lost their 2021 gains and the Terra incident seems to have been the last straw. Soaking in uncertain legislation and economical contexts, everyone is wondering when the cryptocurrency market will recover. Are there any signs?

Is Crypto really in bear territories...?

Unlike the stock market, there really is no set definition to define, nor call a bear market when it comes to digital assets. While in the case of equities, it is considered that we enter a bear market as soon as the stock market values fall by 20% from their recent highs. If we were to apply the same rule to the crypto market, we would consider the market to be bearish on a very regular basis, even in times of bull market.

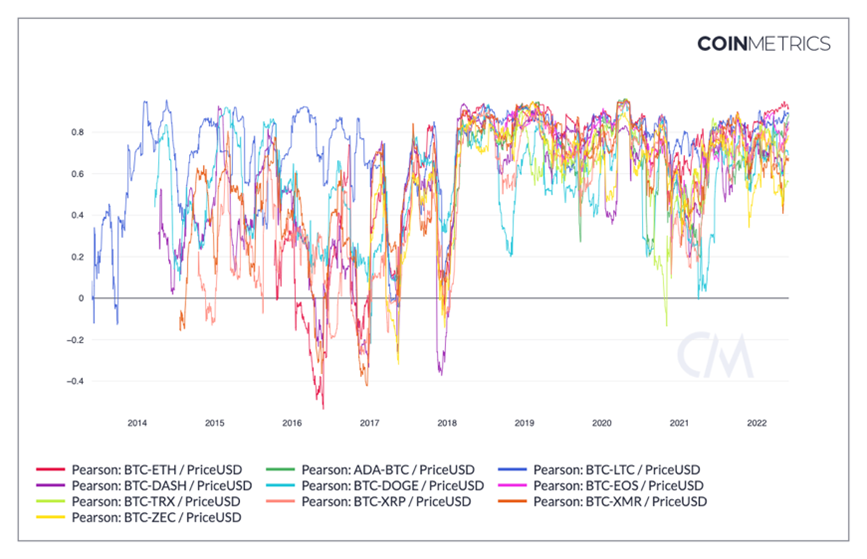

A sound approach to judge a market's bearishness in crypto would be to look at the long term price trend, and particularly the price of Bitcoin. Given the fact that altcoins are highly correlated with Bitcoin: its price therefore gives us a good temperature of the market. However, this measure is limited since what the market had resumed its ascent despite a Bitcoin price that remained ranging in May 2021, similarly to the recent price action with Bitcoin touching its low price ranges like May 2021. Does this mean we will see the same scenario? Perhaps, however the current economic climate will certainly dampen performance. Realistically, everything points to the unpleasant statement that we are indeed in a bear market.

What can we learn from the last market cycles in crypto?

Now that we agree on the bear market situation, let's look at past market cycles to assess the convergence points that may indicate a bear trend exhaustion.

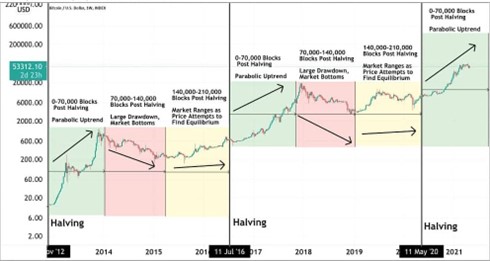

The cryptocurrency market does follow a 4-year cycle, dictated by Bitcoin's halving or halvening -both terms are used- , which is when the btc reward given to miners, for each newly mined block, is halved every 4 years. This brings us back to basic economic concepts: if supply decreases and demand remains the same, the price of Bitcoin increases. And since a BTC-Altcoins correlations is firmly identified, we may agree that the whole crypto market tends to follow the same trajectory.

The last BTC blockchain halving happened in May- June 2020, and in the following months, the price of bitcoin soared, followed closely by other cryptocurrencies. Historically, the bull market following the halving lasts between two and three years, followed by a 12 - 18 months of so called crypto winter. Three possibilities can be expected in our current case:

1_A final major rise before a long-term bear market.

2_The bear market would have already started in November 2021, leaving us with another 6 to 12 months before prices go up.

3_The bear market would have started only with Terra's fall a few weeks ago, which would mean that it could last 12 to 18 months.

Historically, it seems that the latter is the most likely possibility, given that the next halving is in two years. Until then, the price of cryptocurrencies may fall further, and crash for most. Nevertheless, we must agree that most vaporware, ghost project will crash then vanish and we must keep in mind that this analysis is only accurate as long as the 4-year theory remains valid, which has been questioned recently.

Stock Markets Influence & Correlation.

Since the end of 2020, Bitcoin has become an integral part of many institutional portfolios, simultaneously to the approval of several new investment vehicles pegged to BTC and others digital assets. Bitcoin's highest price also came in line with the approval of the first Bitcoin Futures ETF on the New York Stock Exchange in early November. It is also notable that the launch of Bitcoin futures on the Chicago Mercantile Exchange in December 2017 also coincided with the highs at the time while coinciding with its 2018 decay.

Therefore, it is undeniable that many institutional investors have thrown Bitcoin into the same basket as other risk-on assets, such as tech stocks. The very evidence of this move is proven by the increasing correlation between these two types of assets over the past 12 months.

Let's keep it short and simple, when tech stocks prices rise, so does the price of Bitcoin and vice versa. And that's why indices like the S&P 500 and Nasdaq can become useful elements in trading and anticipating the price of Bitcoin.

Plus, keep in mind that the stock market has been booming for a decade which has convinced many the recent declines are just the beginning of a bubble bursting in front of us. Although it is still a little early to come to any conclusions, one thing is certain: the equity market has probably entered a bear market, with both feet. It has indeed reached this 20% decline from its recent highs in the course of May. Bear markets in the equity market have historically lasted 1 year.

The longest bear market of the last 30 years was probably the one that followed the Dot-com crisis, which lasted about 2 years. Moreover, many experts have drawn parallels between this bubble and the current cryptocurrency market and if this comparison proves to be valid, it could indicate that the crypto bear market could well last for two years, regardless of what happens to the stock market. This scenario could align with previous bear markets, but there are still three possible scenarios to discuss here.

1_Bitcoin could break out of its correlation with the equity market, which is unlikely given the scale of institutional investment.

2_The cryptocurrency market could enter a bear market for a year and then be pulled by the equity market to new highs.

3_Our economy could enter a recession, which would mean a bear market of at least two years for cryptocurrencies, if not longer

And the FED Cycle!

The uptrend of the worldwide equity markets have been largely influenced by the generous monetary policies of central banks, and more specifically that of the U.S. central bank, the FED.

When the Fed cuts interest rates, the price of goods and various assets tends to rise. Conversely, a rise in rates causes prices to fall. The Fed has been continually cutting interest rates for decades, so it is no surprise that we have seen asset prices rise over the same period; many Bitcoin critics openly argue that the non stop markets' stimulation and boosting by the FED is a direct cause of prices booming in risk-on assets like cryptocurrencies (this argument is valid).

In the case of equities, many stocks are trading at multiples well above what their earnings could justify. There is little doubt that this is also the case for multiple cryptocurrencies, with prices sometimes hardly justified by their fundamentals. So what happens to the cryptocurrency and equity markets when the Fed raises rates?

We could see the beginnings of an answer when Jerome Powell raised the idea of a rate hike last November. Indeed, both stock prices as well as cryptocurrency prices have not stopped falling ever since and with looming hawkish stances by American and European regulators a deeper crash or a slow bleeding won't be a surprise, at all.

It was in March that the Fed finally raised rates for the first time since 2018. History suggests that the Fed could continue to raise rates for two or three years before going the other way. Of course, this all depends on how long our beloved inflation, the primary reason for this monetary policy, lasts. The latest estimates suggest that US inflation should return to its 2% target within two to three years. Again, this gives us three potential scenarios:

1_Bitcoin could decouple from the influence of rates, which is unlikely, given that institutional investors tend to put their funds into non-risky assets when rates are high.

2_The current bear market could continue for the estimated duration of the rate hike, which could be two years or more.

3_Eventually, the Fed could be forced to stop raising rates for whatever reason, which would likely send cryptocurrencies and stocks back on an upward trajectory. Unfortunately, this scenario is also unlikely, as it would likely create too much inflation.

While economic morass and panic are reigning these days and many investors are depressed staring at their portfolios melting, it's important to remember that like all bull runs, bear markets do end.

One thing is certain, it is when markets bleed that the best value projects, either crypto or not, can hit discount prices, that's when the daring intelligent investors stays rational and buy the strongest assets at liquidations prices, this might be what is about to happen before us.